25 April 2025

Employee vs. freelancer in Portugal: how to avoid misclassification penalties

Expanding your business into Portugal opens up access to a skilled, multilingual workforce and a thriving tech and startup ecosystem. But with opportunity comes responsibility—especially when it comes to workforce compliance. One of the most common mistakes international employers make when hiring in Portugal is misclassifying freelancers as employees.

This might seem like a harmless shortcut, especially in the early days of international expansion. But under Portuguese law, treating a worker like an employee while paying them as a freelancer can result in significant fines, legal trouble, and damage to your company’s reputation.

In this guide, we’ll explore the legal definitions of employee vs freelancer in Portugal, outline the risks of worker misclassification, and explain how a Portuguese Employer of Record can help you stay compliant while building your team.

Why worker classification matters

When businesses misclassify a worker—intentionally or not—they sidestep legal obligations such as social security contributions, paid leave, and employment protections. This disadvantages the worker and exposes the company to potential labour disputes, back payments, and financial penalties.

In Portugal, misclassification is especially risky because the labour authorities, known as ACT (Autoridade para as Condições do Trabalho), actively investigate improper work arrangements. Even if you have a signed freelance agreement, authorities will evaluate the actual working relationship. If it resembles employment, the consequences can be serious.

Defining employment status in Portugal

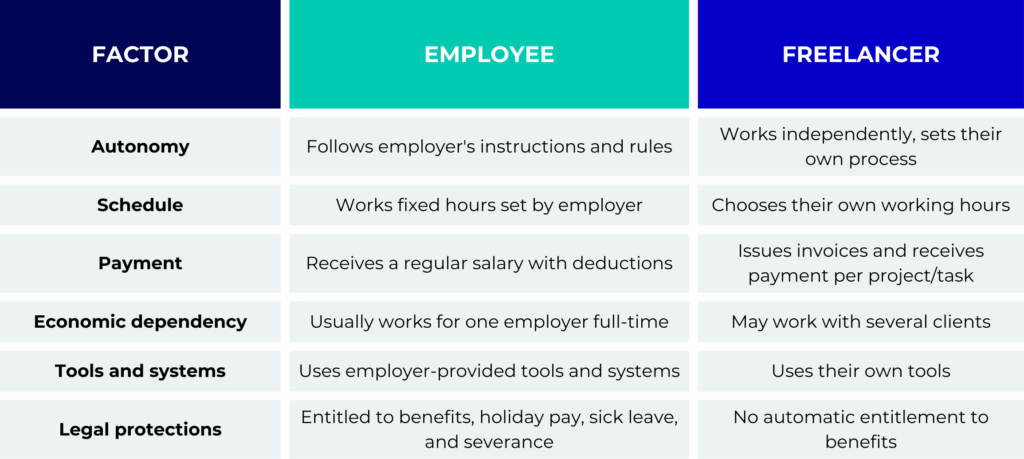

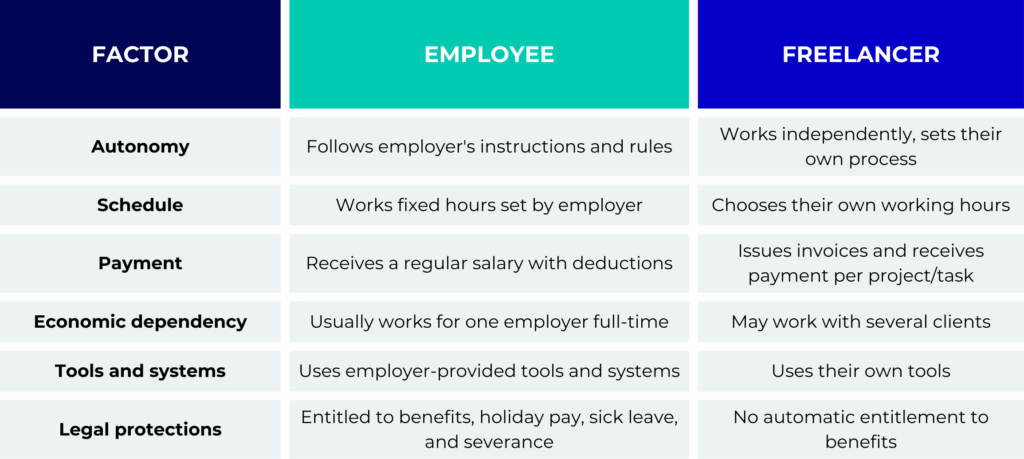

Under Portuguese law, an employee (trabalhador dependente) performs work under an employer’s authority and direction. The employer sets the rules, dictates working hours, and provides the tools and systems used for the job.

On the other hand, a freelancer (trabalhador independente) offers services independently. They control how they work, are responsible for their own taxes and social security, and typically work with multiple clients.

Key differences between employees and freelancers:

Why misclassification happens

Many companies turn to freelancers as a flexible way to hire talent without setting up a local subsidiary or committing to full employment obligations. And with remote work becoming the norm, it’s easy to assume that independent contractors can be used interchangeably with employees.

However, problems arise when companies treat freelancers like full-time employees – assigning them fixed schedules, requiring regular reports, or expecting exclusive collaboration, without offering the legal benefits that come with employment.

This often happens unintentionally, especially when HR and legal teams are unfamiliar with freelancer regulations in Portugal.

Legal risks and penalties for misclassification

When a freelancer is found to be working in conditions similar to an employee, labour courts may reclassify the relationship, even retroactively. This opens the door to several financial and legal consequences, including:

- Fines imposed by ACT for violating labour law

- Back payments of social security, taxes, holiday pay, and overtime

- Employment reclassification, making you liable for all employment obligations from the start of the working relationship

- Interest charges on delayed contributions

- Audits that may affect your broader operations in Portugal

- Reputational damage, especially if disputes become public

These risks can escalate quickly, especially if you’re hiring multiple freelancers or scaling operations in Portugal without understanding local labour laws.

How to classify workers correctly in Portugal

Companies should carefully assess each worker’s status before hiring to avoid these pitfalls. Start with an essential checklist:

- Does the person report to your team daily?

- Does your business control their working hours and activities?

- Do they rely exclusively on your company for income?

- Are they using your systems, tools, or email accounts?

If the answer is yes to most of these, the worker is likely functioning as an employee and should be treated as such under Portuguese law.

It’s also essential to document everything clearly. Contracts should accurately reflect the nature of the relationship, not just in wording, but in practice. A formal employment contract may be more appropriate if you’re engaging someone long-term or assigning regular tasks that resemble employee responsibilities.

How an Employer of Record helps avoid misclassification risks

If you’re unsure about local compliance or want to hire in Portugal without setting up a legal entity, working with an Employer of Record (EOR) can be a smart solution.

An EOR is a third-party organisation that legally hires employees on your behalf. While you manage the person’s day-to-day work, the EOR becomes the legal employer in Portugal, ensuring full compliance with local labour law, tax codes, and social security obligations.

How an EOR ensures correct classification

By hiring workers as employees through an EOR, you eliminate the risk of misclassification. The EOR will:

- Draft employment contracts that follow Portuguese labour regulations

- Handle payroll, tax filings, and social contributions to Segurança Social

- Provide employee benefits such as paid holidays, maternity leave, and sick pay

- Stay up to date on changing employment laws and ensure continued compliance

This is especially helpful for companies hiring full-time contributors, testing the Portuguese market, or managing remote teams across borders.

For example, a growing SaaS company in Berlin expanded into southern Europe and began hiring freelance developers in Lisbon. After a few months, the developers worked exclusively for the startup, using the company’s tools and following standard sprint cycles, just like in-house employees.

The startup’s legal team flagged a misclassification risk. Rather than setting up a local Portuguese entity, they engaged a Portuguese EOR. The EOR transitioned the developers into fully compliant employment contracts under Portuguese law. This prevented possible legal action from ACT and helped the startup improve retention by offering benefits like health coverage and paid holidays.

When to consider an EOR in Portugal

An Employer of Record is ideal if you:

- Plan to hire a long-term contributor who’s currently a freelancer

- Are unsure how to classify your workers

- Want to avoid setting up a legal entity during your initial expansion

- Need to quickly onboard talent without risking legal issues

Using an EOR reduces administrative overhead while ensuring you meet every legal requirement from the start.

For instance, a fintech company based in the Netherlands began hiring customer support reps in Portugal to cover southern Europe. Initially, they classified the reps as independent contractors for cost efficiency. But as the team grew, so did the risk – most of the reps worked fixed shifts, reported to supervisors, and had no other clients.

After engaging an employment lawyer in Lisbon, the company shifted to a more secure model. With an EOR, they could keep their Portuguese team intact while ensuring compliance with local labour laws. The EOR issued compliant contracts, managed statutory benefits, and handled all payroll requirements, giving the company peace of mind and scalability.

Final tips for compliant hiring in Portugal

Misclassification risks in Portugal can often be avoided with the right preparation and local understanding. It’s essential for employers to take a proactive approach – this means regularly reviewing freelance agreements to ensure they reflect the reality of the working relationship, and not just what’s written on paper.

When uncertainties arise, especially regarding legal or tax obligations, consulting with local HR or legal professionals can clarify and prevent costly errors.

For businesses expanding into Portugal or working with remote teams, partnering with an Employer of Record or trusted payroll provider offers an extra layer of protection. They handle the legal and administrative requirements, making it easier to stay compliant.

Above all, documenting each working relationship thoroughly and ensuring responsibilities align with the agreed contract type helps maintain transparency and reduce the risk of legal disputes.

Hire with confidence in Portugal

Portugal offers incredible opportunities for international companies, but it also comes with a unique legal framework that must be respected. By understanding the difference between employees and freelancers, and taking proactive steps to ensure compliance, you can avoid costly penalties and build a strong foundation for growth.

If you’re hiring in Portugal and want to avoid misclassification risks, we’re here to help. Contact us to learn how our Portuguese Employer of Record services can support your hiring goals, compliantly and confidently.