10 June 2025

Subsidiary vs. branch office in Portugal: which is the right choice?

Portugal has steadily climbed the ranks as one of Europe’s most appealing markets for business expansion. With its skilled workforce, strategic access to European and global markets, and favourable business climate, it’s no wonder more international companies are choosing to establish a presence here.

However, once you’ve decided to expand to Portugal, the next crucial step is determining how to set up locally. Should you form a subsidiary or open a branch office? Or is there a way to hire and operate without setting up a legal entity at all?

In this guide, we’ll explain the key differences between a subsidiary and branch office in Portugal, look at the pros and cons of each structure, and introduce Employer of Record solutions as a flexible alternative for businesses seeking a faster, lower-risk entry into the Portuguese market.

What is a subsidiary in Portugal?

A subsidiary in Portugal is a separate legal entity, usually set up as a Sociedade por Quotas (LDA) — the Portuguese equivalent of a limited liability company. Though owned by a foreign parent company, the subsidiary is incorporated under Portuguese law and operates independently.

The subsidiary has its own tax identification number, bank account, and accounting records. In most cases, companies appoint local directors, although this isn’t always legally required. Setting up a subsidiary provides businesses with operational autonomy, allowing them to enter into contracts, hire staff, and manage day-to-day business activities in Portugal as a locally recognised entity.

This model is best suited for companies planning significant long-term investment, building local teams, and establishing themselves in the Portuguese market as a fully operational branch of their brand.

What is a branch office in Portugal?

A branch office differs from a subsidiary in that it is not a separate legal entity. Instead, it acts as an extension of the foreign parent company, meaning the parent remains legally and financially responsible for all actions carried out by the branch.

To operate legally, a branch office must register with the Portuguese Commercial Registry and obtain a tax identification number. Although a branch can conduct business activities, its operational scope is more limited than that of a subsidiary. The parent company maintains direct control, and the branch cannot independently sign contracts in its name without involving the parent.

Branch offices are often used when companies want to test the Portuguese market or manage limited activities like sales and marketing, without fully incorporating or assuming the additional administrative burden of running an independent business.

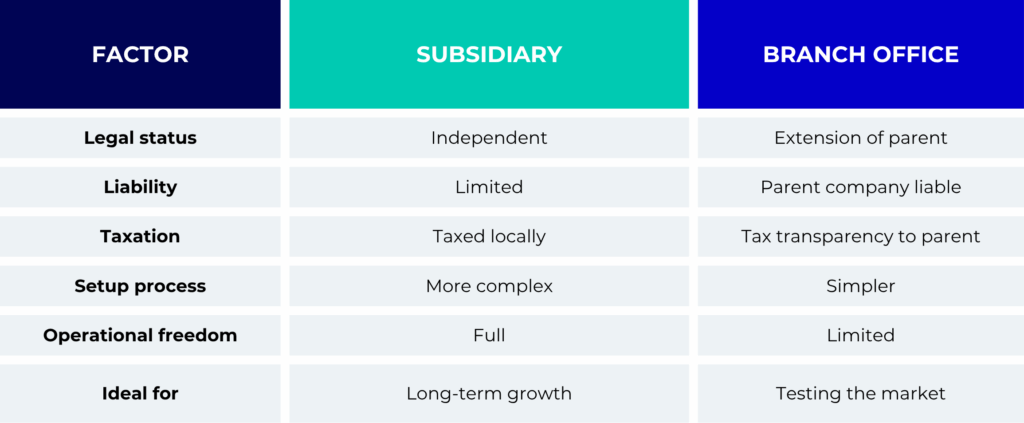

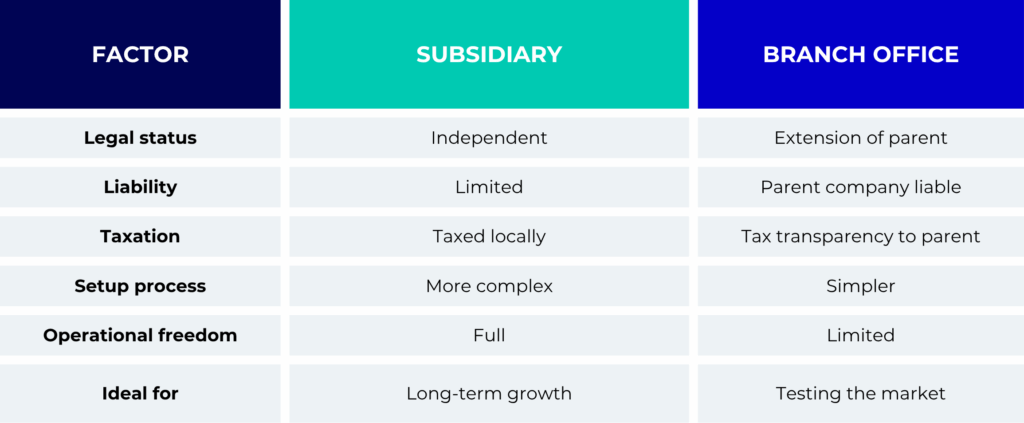

Subsidiary vs. branch: pros and cons

Understanding the core differences between a subsidiary and a branch office in Portugal is vital before choosing your path.

A subsidiary offers complete legal independence and operates as a standalone entity, shielding the parent company from liabilities. It’s taxed independently in Portugal and has its own local reporting obligations. On the other hand, a branch remains legally tied to its parent, with the parent company liable for any legal or financial issues arising from the branch’s operations. Taxation is generally transparent back to the parent company, which can simplify or complicate international tax reporting depending on your structure.

Setting up a subsidiary is a more complex process, requiring formal incorporation, company statutes, directors, and local bank accounts. Branches are faster and less expensive to establish, but they offer less operational freedom and may not deliver the same level of credibility with clients, partners, or investors.

When considering operational flexibility, subsidiaries can enter into contracts, employ local staff, and fully engage in local activities. Branches are best suited for companies needing a lighter footprint, focusing on sales, customer service, or marketing.

Costs and compliance considerations

Setting up a subsidiary involves higher initial costs, not just incorporation fees, but also expenses related to legal advice, accounting, and corporate governance. Companies must also comply with Portuguese corporate tax rates, VAT obligations, and annual reporting to the Commercial Registry.

Employment regulations apply to both subsidiaries and branch offices. Both must comply with Portuguese labour laws, including providing statutory benefits such as paid leave, social security contributions, and adhering to dismissal procedures. Accurate payroll processing, tax withholdings, and local representation are non-negotiable elements of operating legally in Portugal.

For businesses hesitant to take on these responsibilities, or simply wanting to avoid the costs and long-term commitment of incorporation, there is an alternative.

EOR as a flexible alternative to setting up a legal entity

An Employer of Record (EOR) offers companies a streamlined way to hire and operate in Portugal without setting up a subsidiary or branch.

An EOR is a local partner that employs workers on your behalf. While you retain full control over the employee’s tasks and responsibilities, the EOR becomes the legal employer for compliance, payroll, tax, and benefits purposes.

Through a Portuguese EOR, companies can:

- Hire employees quickly without waiting for entity registration.

- Ensure full compliance with Portuguese labour laws, tax regulations, and social security contributions.

- Offer employee benefits, such as healthcare, paid leave, and pension contributions, seamlessly through a compliant structure.

- Manage employment contracts without the legal and financial risks associated with direct hiring through a foreign entity.

An EOR is particularly valuable for businesses wanting to test the market, run remote teams, or hire individual employees without committing to the entire cost and complexity of setting up a permanent establishment.

For instance, when a US-based SaaS company wanted to test the Portuguese market, they knew setting up a subsidiary would be costly and time-consuming. They needed to hire a local sales manager quickly, but didn’t want to commit to establishing a legal entity before validating the market.

By partnering with a Portuguese Employer of Record, they were able to onboard the new employee in a matter of days, ensuring full compliance with Portuguese employment laws, payroll, and tax obligations. The EOR handled all administrative responsibilities, enabling the company to focus on business development without the risks and overhead associated with setting up a branch or subsidiary. After 12 months of strong growth, they moved ahead with forming a subsidiary, but only once they were confident of the opportunity.

Compared to working with a subsidiary or branch, partnering with an EOR significantly reduces the time to market. It eliminates upfront incorporation costs and allows businesses to adapt quickly if market conditions change, without the burden of winding down a legal entity.

When to choose each option

Choosing between a subsidiary, a branch office, or an EOR depends on your business’s goals, budget, and risk tolerance.

A subsidiary is the right choice if you are planning long-term growth, need operational autonomy, or want to protect your parent company from liabilities fully. It’s ideal for companies seeking to establish a strong brand presence, secure local contracts, and develop substantial operations.

A branch office suits businesses seeking to test the market or establish a limited presence with lower initial investment. It’s also useful for companies with minimal local operations that prefer direct control from their parent company.

An EOR is ideal if you want to hire quickly, stay flexible, and avoid the complexity of setting up a legal entity. It’s handy for companies hiring a few employees, managing remote-first teams, or launching short-term projects in Portugal.

Choose the right option for your business

Deciding between a subsidiary and a branch office in Portugal is not just a legal formality, it has real implications for how you operate, hire, manage risk, and grow.

While subsidiaries offer complete independence and long-term growth potential, branches provide a faster and more cost-effective entry point, albeit with greater exposure for the parent company. For businesses prioritising speed, flexibility, and low risk, an Employer of Record offers an excellent solution for hiring employees in Portugal without establishing a local legal entity.

Need to hire in Portugal without setting up a legal entity? Get in touch with our team to learn how an Employer of Record can simplify your expansion strategy and support your growth plans.